Embark on a journey towards financial freedom with the insightful strategies Artikeld in 'How to Get Out of Debt for Free: Real Strategies That Work.' This opening passage sets the stage for a comprehensive exploration of practical tips and proven methods to break free from debt shackles.

The following paragraph will delve deeper into the intricacies of debt management and offer valuable insights for a debt-free future.

Introduction to Debt and its Impact

Debt is a financial obligation that arises when one borrows money from a lender or creditor. It can come in various forms, such as credit card debt, student loans, mortgages, or personal loans.

Carrying debt can have serious implications on one's personal finances, leading to a cycle of borrowing, high-interest payments, and financial stress. It can also impact credit scores, making it harder to secure loans or obtain favorable interest rates in the future.

The Consequences of Debt Accumulation

- Debt can snowball over time, with interest charges adding up and making it harder to pay off the principal amount.

- Missed payments or defaulting on loans can result in penalties, fees, and even legal action from creditors.

- High levels of debt can limit one's ability to save for the future, invest in assets, or achieve financial goals.

- Debt can also have emotional and mental health impacts, causing stress, anxiety, and strain on relationships.

Evaluating Your Debt Situation

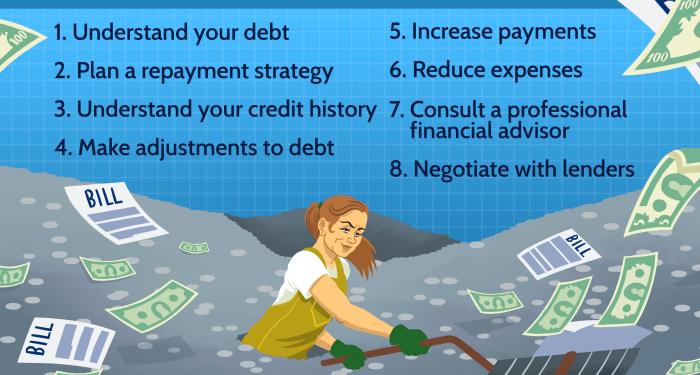

When it comes to getting out of debt, the first step is to evaluate your current financial situation. This involves calculating your total debt amount, understanding the interest rates and terms of each debt, and organizing them for effective prioritization.

Assessing Your Total Debt Amount

To determine your total debt amount, gather all your financial statements, credit card bills, loan documents, and any other relevant paperwork. Add up the outstanding balances to get an accurate picture of how much you owe.

Understanding Interest Rates and Terms

It's crucial to understand the interest rates and terms of each debt you have. High-interest debts can quickly accumulate more interest, making it harder to pay off. Take note of any penalties, fees, or changes in interest rates to plan your repayment strategy accordingly.

Organizing Debts by Interest Rates

One effective way to prioritize your debts is to organize them from the highest to the lowest interest rates. By focusing on paying off high-interest debts first, you can save money in the long run and accelerate your journey to becoming debt-free.

Consider making minimum payments on low-interest debts while putting extra money towards high-interest debts to expedite the payoff process.

Creating a Budget and Cutting Expenses

Creating a budget is a crucial step in managing debt effectively. It allows you to have a clear overview of your financial situation and helps you allocate funds for debt repayment. Here's how you can create a budget and cut expenses to free up more money for paying off your debts.

Developing a Budget Plan

Creating a budget starts with listing all your sources of income and expenses. Calculate your total monthly income and compare it to your expenses to determine how much you can afford to allocate towards debt repayment. Use online budgeting tools or apps to help you track your finances effectively.

Reducing Unnecessary Expenses

Identify areas where you can cut back on spending to free up more funds for debt repayment. Consider eliminating non-essential expenses such as dining out, subscription services, or impulse purchases. Look for cheaper alternatives or consider DIY solutions to save money.

Importance of Tracking Spending

Tracking your spending is essential to identify areas where costs can be cut. Keep a record of all your expenses, including small purchases, to have a clear understanding of where your money goes. This will help you make informed decisions on where to cut back and prioritize debt repayment.

Negotiating with Creditors and Consolidating Debt

When facing overwhelming debt, negotiating with creditors and exploring debt consolidation options can be effective strategies to help you get back on track financially. By negotiating with creditors, you can potentially secure lower interest rates or extended payment terms, making it easier to manage your debt.

Debt consolidation, on the other hand, involves combining multiple debts into a single payment, often with a lower interest rate. This can simplify repayment and make it more manageable.

Negotiating with Creditors for Lower Interest Rates or Extended Payment Terms

- Reach out to your creditors directly to discuss your situation and explore potential options for lower interest rates or extended payment terms.

- Be honest and transparent about your financial difficulties and demonstrate your commitment to repaying your debts.

- Highlight any changes in your financial circumstances that may have impacted your ability to make payments on time.

- Consider enlisting the help of a credit counseling agency to negotiate with creditors on your behalf and come up with a feasible repayment plan.

Debt Consolidation Methods

- Balance Transfers:Transfer high-interest credit card balances to a new credit card with a lower interest rate, often with an introductory promotional period.

- Personal Loans:Take out a personal loan to pay off multiple debts, consolidating them into a single monthly payment with a potentially lower interest rate.

- Debt Consolidation Loans:Obtain a specific loan designed for debt consolidation purposes, allowing you to combine all your debts into one loan with fixed terms.

Increasing Income and Seeking Additional Support

Increasing your income can be a crucial step in getting out of debt faster. By exploring various ways to boost your earnings and seeking additional support through financial assistance programs, you can make significant progress towards becoming debt-free.

Side Hustles and Part-Time Work

- Consider taking on a side hustle or part-time job to supplement your primary income.

- Freelancing, online tutoring, pet sitting, or delivering food are popular options for generating extra cash.

- Allocate the additional income towards paying off your debts to accelerate the repayment process.

Credit Counseling and Debt Relief Programs

- Seek assistance from credit counseling agencies that offer free or low-cost services to help you manage your debts effectively.

- Debt relief programs may provide options for debt consolidation, negotiation with creditors, or creating a structured repayment plan.

- Research reputable organizations and compare their services to find the best fit for your financial situation.

Free Financial Education and Support Services

- Take advantage of free resources available online or in your community to improve your financial literacy.

- Platforms like financial blogs, podcasts, and workshops can offer valuable insights on budgeting, saving, and debt management.

- Community centers, libraries, and non-profit organizations may also provide workshops or counseling services to help individuals in debt.

Celebrating Milestones and Staying Motivated

As you progress on your debt repayment journey, it's crucial to celebrate small victories along the way. These milestones not only mark your progress but also provide the motivation needed to stay focused on your long-term financial goals.

Importance of Celebrating Small Victories

Celebrating small milestones, such as paying off a credit card or reaching a savings goal, can help boost your morale and keep you motivated. It reinforces the idea that your efforts are paying off and encourages you to continue making positive financial decisions.

- Acknowledge your achievements, no matter how small, to maintain a positive outlook.

- Reward yourself in a budget-friendly way, such as treating yourself to a small indulgence or enjoying a simple pleasure.

- Share your progress with a trusted friend or family member for added support and encouragement.

Staying Motivated and Focused

Staying motivated throughout the debt repayment process can be challenging, but there are strategies to help you stay on track.

- Visualize your debt-free future and the financial freedom it will bring to stay motivated.

- Set specific, achievable goals to track your progress and maintain focus.

- Find a support system, whether through a financial advisor, online community, or accountability partner, to keep you motivated.

Maintaining a Positive Mindset

Dealing with debt can take a toll on your mental well-being, but it's important to maintain a positive mindset throughout the process.

- Acknowledge your emotions and practice self-care to manage stress and anxiety related to debt.

- Focus on the progress you've made rather than the remaining debt to stay optimistic about your financial future.

- Avoid comparing your financial situation to others and stay committed to your individual journey towards financial stability.

Outcome Summary

In conclusion, the discussion encapsulates key strategies and approaches to conquer debt and pave the way for a stable financial future. Discover the tools and mindset needed to overcome debt challenges and achieve lasting financial wellness.

Common Queries

How long does it typically take to get out of debt using these strategies?

It varies depending on individual circumstances, but with commitment and discipline, significant progress can be made within a few months to a few years.

Are there any risks involved in debt consolidation?

While debt consolidation can simplify repayment, there may be risks such as accruing more debt if spending habits are not addressed.

Is seeking financial assistance through credit counseling a good idea?

Credit counseling can provide valuable guidance and support in managing debt, making it a beneficial option for many individuals struggling with financial obligations.